Top Productivity Tips for 2015 [Social Media Minute]

Taking time off to rest, rejuvenate and replenish our reserves can be one of the most productive things to do.

___

While we take time off for ourselves this week, check out some of our most read productivity tips from the Social Media Minute:

Tip #1: 5 Practical Science-Based Tips to Make You More Productive

Problem: We operate on autopilot most of the day!

Not a bad view from the cockpit. But, not very productive either.

Tip #2: Two-Minute Trick to Increase Confidence and Impact Your Success

Sitting or standing with your head up and shoulders back, in what is often called a “powerful pose,” can:

- Help prevent back pain

- Improve your physical well-being

- Make you better at your job (think social media blogging)

- Reduce stress

- Increase chances for success

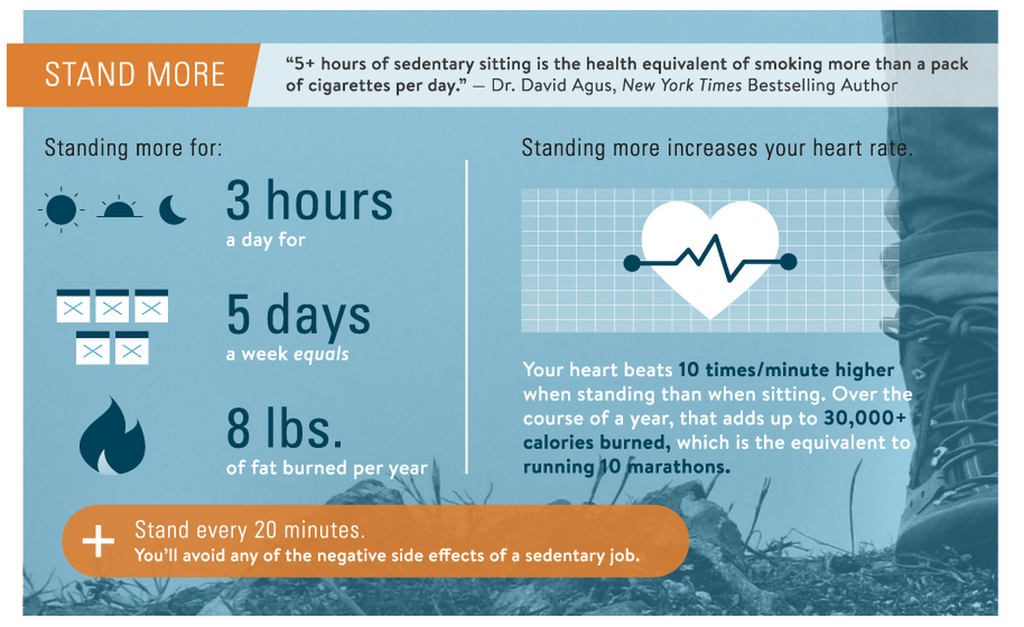

Tip #3 – Sitting is the New Smoking: 4 Simple Tips to Avoid the Negative Side Effects (Infographic)

Stand every 20 minutes. You’ll avoid any of the negative side effects of a sedentary job.

Tip #4 – Yes, You Can Force Yourself to Become a Morning Person. Here’s How. [Infographic]

Waking well-rested starts with getting enough sleep.

Hitting the snooze button a couple times before getting up is a clear sign of sleep deprivation, says Nathaniel Watson, MD, president-elect of the American Academy of Sleep Medicine. If you are getting enough sleep, you should be able to wake up on time without a morning alarm.

Tip #5 – 7 Awesome Standing Desks that Will Change Your Life

Ever get the feeling that your hampster gets more exercise than you do?

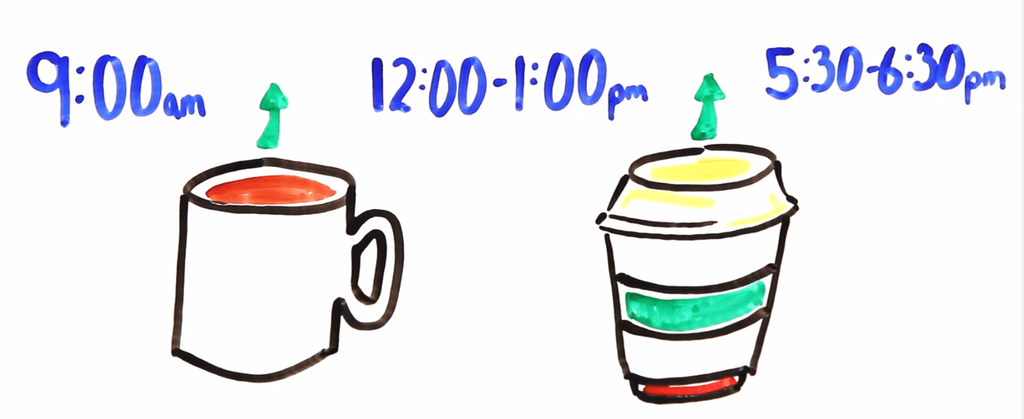

Tip #6 – Hardcore Productivity Hack: The Best Time to Drink Coffee to Boost Performance

We hope your Thanksgiving will be enjoyable, productive and stress-free this season!

Please share our productivity tips!