How To Use Twitter Search To Quickly Find More Happy Customers

Twitter has an estimated 1.3 Billion registered users as of April 2016 that generate a staggering 500 Million tweets a day. As a result, hidden in these Tweets, is a wealth of customer data waiting for you to mine with the right Twitter search tools and knowledge.

To put it another way, Twitter is a goldmine for social media marketers and small businesses looking for customers and trends in a niche.

There are over 2.1 Billion search queries conducted on Twitter every day. We’ll show you how to master Twitter Search to create a compelling social media marketing campaign that boosts blog traffic and generates a positive ROI.

How to Use Twitter Search

There are many ways to use Twitter Search to quickly – find, segment, and filter Twitter’s vast databank of tweets and profiles.

My goal is to show you how you can benefit today so we’ll focus on five compelling use cases that drive real and immediate value from Twitter.

- Introduce Twitter Connect

- Find new customers (in your area)

- Monitor your brand (with sentiment)

- Track the competition (with sentiment)

- Create compelling Tweets

The Twitter Search tools we’ll be using are Twitter advanced search page and the Twitter mobile app.

1.) Twitter Search – What is Twitter Connect?

If you want to grow Twitter followers, the first thing to remember is “follow to be followed“.

In other words, this is a gentle way of saying “Hello, pleased to meet you” without being pushy. As a result, if you follow them, and if they like what they see in your Twitter feed, they’ll follow back.

Success on Twitter (and social media marketing in general) is having the right people to follow.

The purpose of Twitter Connect is to help you find people of interest much quicker than before.

The Connect tab also makes it easier to connect with your friends and family by giving you the option to automatically sync your address book.

If you have the Twitter IOS or Android app installed, look for the tab in the upper left of the screen. Click it to expose a wealth of new people to follow.

Twitter recommends people to follow based on the following:

- Who you already follow

- Tweets you like

- Popular accounts in your local area

- What’s happening in the world right now

Furthermore, this handy Twitter Search tool organizes the recommendations using the above criteria, so you know exactly why Twitter recommended someone.

***You control how good Twitter’s recommendation engine is and the results they display.

For example, let’s say own a pizza joint in San Jose, California. You want to find people who love pizza within your given geographical area. Do a Twitter Search for ‘pizza’ in your zip code (continue reading to learn how). Scroll through the Twitter Search results and like tweets.

In the long run, you’ll start to notice how Connect recommends more people in San Jose who love pizza.

2.) Twitter Search – Find New Customers (NOW)

Next, we are going to use Twitter Advanced search to find new customers near our fictitious pizza joint in San Jose, CA. Once we find these new prospects, we can then direct message them with a coupon.

It’s lunch time, and you want to find people who are hungry for pizza and Tweeting about it right now. Your goal is to drive lunch time traffic.

How do you use Twitter Search to find hungry, loving pizza eaters within a few miles of your pizza parlor?

We’ll keep the Twitter Search simple to start. We are looking for people hungry NOW for pizza near San Jose, CA.

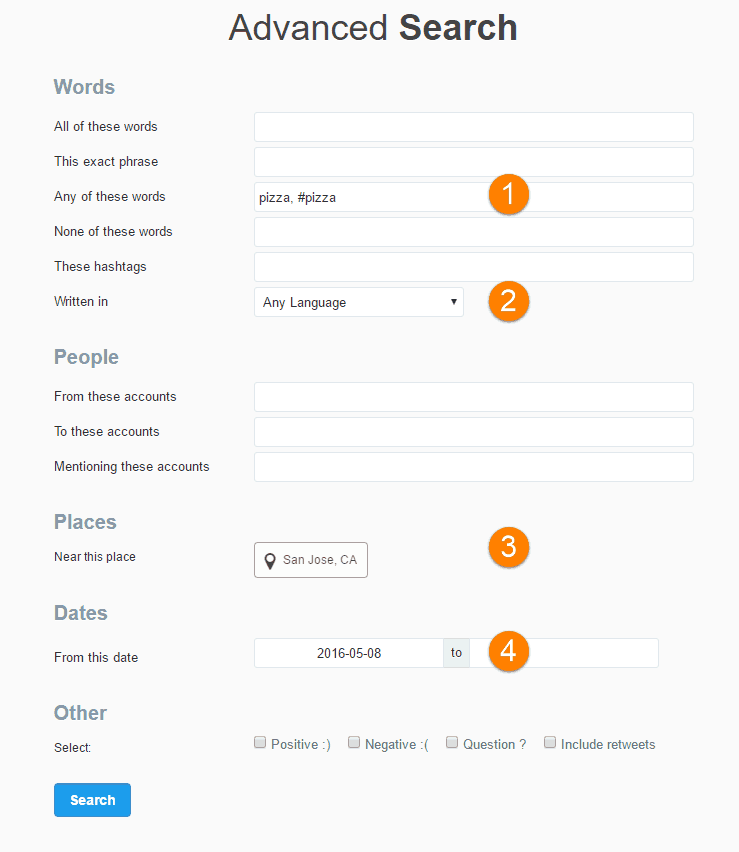

Go to Twitter advanced search and fill in the parameters:

(1) Any of these words: pizza, #pizza (this will find both the word pizza and the hashtag pizza)

(2) Written in: Select a language or leave blank

(3) Near this place: Type in a city or zip code. I chose to find people within 10-miles of my pizza parlor in San Jose

(4) From this date: Enter yesterday’s date and leave “to” blank since we want to find the most recent Tweets. I found this “date sort” delivers the best results.

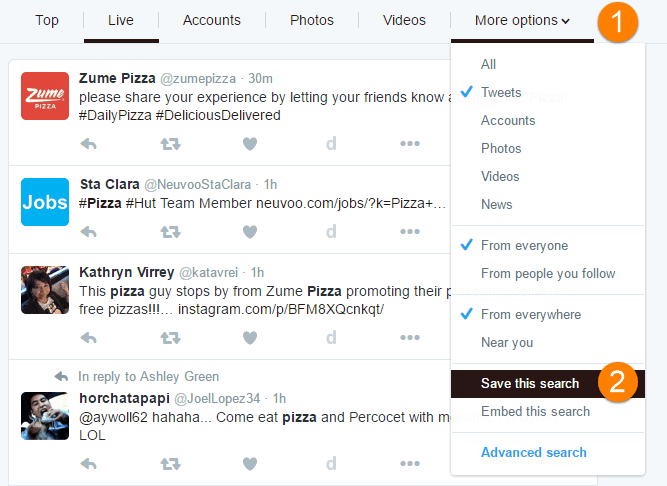

Not only will Twitter Search find people who are tweeting the word ‘pizza’ or ‘#pizza’ but return hungry prospects within 10-miles of San Jose. On the search results page click ‘Live’ to show the most recent conversations about pizza in San Jose.

Talk about a helpful tool!

To emphasize the point, we can target people who want our product right now! Furthermore, you can keep current on all those pizza loving people in San Jose by saving the search.

To save a Twitter Search:

- One the search results page, click ‘More Options’

- Click ‘Save this search’

Now any time Twitter finds a tweet matching your query, you will receive an update as a result allowing you to respond immediately.

Read all about saved searches in Twitter help.

Real-world example:

Enterprise communications provider, Avaya not only uses Twitter Search monitor brand mentions but they use Twitter to find streams of inbound business leads for its products. They listen for cues (key phrases) from prospects who are expressing purchase intent.

Avaya’s team discovered a 57-character tweet. Surprisingly, this tweet kicked off a conversation with a prospect that ended in a closed sale of $250,000 just 13 days after the initial tweet.

Regardless if you are selling pizza or enterprise products, Twitter Search is a productive tool to weed through the sea of tweets to find sales opportunities.

3.) Twitter Search – Brand Monitoring (with Sentiment)

When using Twitter Search, it’s important to think of it as a live conversation charged with an array of emotions – happy, sad, mad, neutral, etc.

As a result, you can find people who love you or are frustrated – in real time. In either case, it’s a good idea to thank them for their feedback or dive deeper into the source of their frustration.

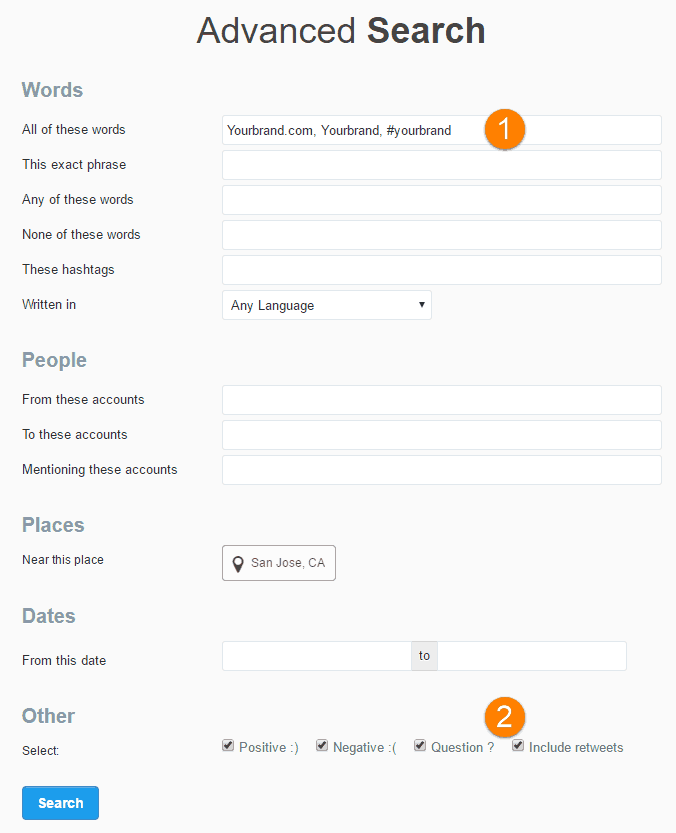

Go to Twitter Advanced search and fill in the parameters:

(1) All of these words: Any variation of your brand, your domain, product, Twitter handle.

(2) Other: Select the sentiment – positive, negative. Include questions and retweets in the query.

As a result, you now have all mentions of your brand. Save the search like above. Respond appropriately.

4.) Twitter Search – Competitive Monitoring (with Sentiment)

Searching for competitors is similar to how we showed you to use Twitter Search to monitor your own brand. In ‘All of these words’, type in all variations of your competitors. A point often overlooked is to include the sentiment information.

You can save one search for each competitor you are following or do them all in the same search.

As a result of these new found Tweets you can:

- Learn how your competitor’s customers talk about your competitors because this insight will help you to position your product. For example, if their customers use certain words to describe your competitor, include this information in Tweets you use or in your product information.

- Respond immediately to any of your competitor’s customers that are frustrated because you can swoop in and steal customers away from competitors.

5.) Twitter Search – Find Awesome Gifs

Another important point is to compose eye-catching and engaging Tweets with Twitter images. As a matter of fact, in 2015, 100 Million animated gifs were shared on Twitter.

Consequently, Tweets with images improve engagement:

- Color visuals increase the willingness to read content by 80%

- Visuals positively affect participation (reading, clicks, shares, purchases) by 80%

Want your Tweets to be seen? Include images!

You can search and browse Twitter’s GIF library when you compose a Tweet in the Twitter app. Just click the GIF button to do a Twitter Search for the perfect image! You can search by keyword, or browse categories of different reactions like Pizza, Food, or Pizza ;-).

The GIFs are coming! Get ready to search and send GIFs in Tweets and Direct Messages: https://t.co/uk75stt1zN pic.twitter.com/1dDD1B4CW2

— Twitter (@twitter) February 17, 2016

For more information, read Twitter’s complete guide on using Advanced Twitter Search (after you master the basics above).

___

Next up: Read 9 ways to quickly grow Twitter followers.

Have any Twitter search tips or tricks not mentioned? Please share in the comments!